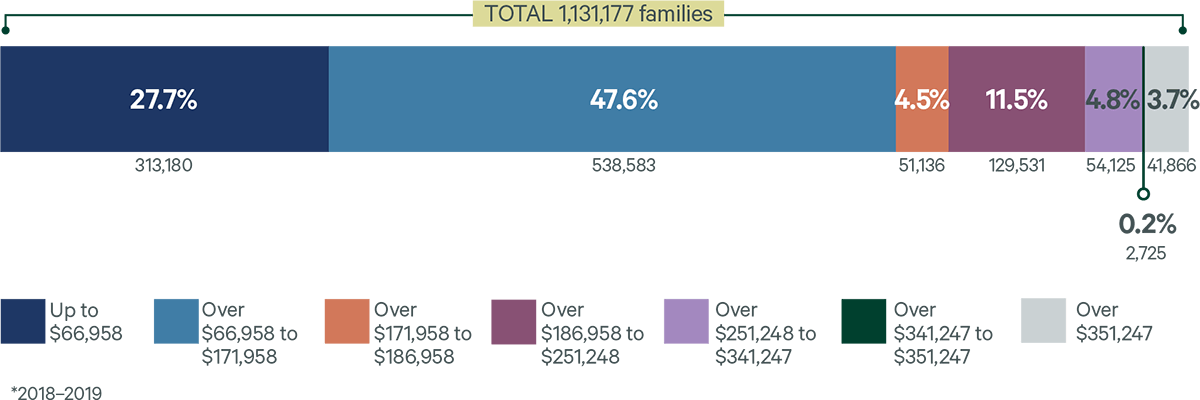

From 10 July 2023, the Child Care Subsidy rates increased which means most families using childcare now receive more subsidy. The CCS percentage you’re entitled to depends on your family’s income.

The maximum amount of CCS increased from 85% to 90% for families earning up to $80,000. The income limit for CCS also increased from $356,756 to $530,000.

The maximum amount of CCS of 90% will go down by 1% for each $5,000 of income your family earns. You’ll either getmore subsidy or have no change to your entitlement.

If you have more than one child aged 5 or under, you may receive a higher CCS rate for one or more of your children. The low income limit for Additional Child Care Transition to Work subsidy has also increased to $80,000.